BUSINESS

Green Organic Dutchman Holdings Ltd (OTCMKTS:TGODF) Reports Revenues Of $3.25 Million In Q4 2019

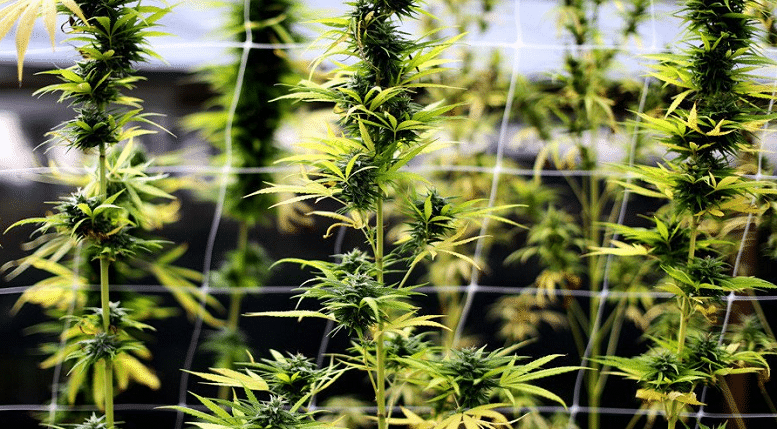

Green Organic Dutchman Holdings Ltd (OTCMKTS:TGODF) has reported revenues of $3.25 million from European and Canadian operations in Q4 2019. The newly introduced CBD topicals and other products in Europe contributed to the sales of $2.56 million. Also, limited manufacturing from the Ancaster facility contributed to the sales in Q4.

Unveils a strategic plan to reduce financing requirement

Green Organic has unveiled a strategic, operating, and construction plan to reduce financing requirements. It is in line with the need to calibrate the cultivation facility construction for Canadian market conditions. The company has demarcated the construction of its Valleyfield facility into small phases. It keeps the options open for the expansion based on the market requirements.

Expands distribution footprint in Canada

Green Organic has significantly expanded the distribution footprint in Canada. The company has received several orders from the cannabis boards of Manitoba, Nova Scotia, Newfoundland, British Colombia, Alberta, and Saskatchewan. It also unveiled two cannabis strains in Ontario.

Health Canada Grants license amendment

Health Canada has granted a license amendment to Green Organic to commence the cultivation operations in two zones at Valleyfield facility. Green Organic also arranged a bought financing deal for $27.6 million. It also arranged a senior secured first line credit facility for $27.7 million with a commercial lender. The company doesn’t need to pay the principle in the first twelve months.

In the second tranche, the company will receive funds of $15 million on achieving certain operational milestones and on getting the nod of the credit committee of the lender. The company issued 7 million common share purchase warrants to the lender. It will also look for other financing options to meet operational needs.

Developments after Q4

Health Canada has granted a research license to Green Organic. The license is valid for five years and allows the company to accelerate the development of new products. It also helps the company to achieve economies of scale and reduces the dependency on third parties.

The Canada Organic Trade Association has awarded a ‘Leadership in farming’ award. It also began the sale of infusers. Chief Executive Officer of Green Organic, Brian Athaide, said the company achieved significant progress in 2019 despite challenges for the cannabis sector.

BUSINESS

Trulieve Cannabis Corp (OTCMKTS: TCNNF) Announces a Listening and Education Tour

Trulieve Cannabis Corp (OTCMKTS: TCNNF) will host a Listening and Education Tour. The tour aims to meet with local leaders and exchange ideas. It will cover topics like expungement, agricultural, economic, and medical opportunities in the cannabis industry.

Champ Bailey will moderate the event

Champ Bailey, a football Hall of Famer and the chief diversity officer at Trulieve Georgia, will moderate the event. Additionally, Trulieve will hold its first event at the Carolyn Harris Performing Arts Center, Adel.

According to Bailey, a resident and native of Georgia, he is excited to meet experts and teach people the medical benefits of cannabis. He adds that Trulieve will make several tour stops to meet with community leaders. With the help of these leaders, the company will teach locals about how the cannabis industry could change the community. It will also create local support programs.

Experts that will be at the events

Moreover, the programs will have various industry experts, including Jim Wernick, the Director of State Expansion at Trulieve; Dr. James Lillard, the lead researcher at more house school of Medicine; Chase Daughtrey, a Cook County Judge, Heather Green, the president of the Adel-cook County Chamber of Commerce, and Luther Duke, the Mayor of Adel.

Trulieve is asking communities to submit questions before each stop through its emails. After the sessions, the company will also try to develop ways to help the community.

Trulieve is a cannabis company that operates in 11 U.S states. It has leading operations in Pennsylvania, Florida, and Arizona. Its other locations are Maryland, West Virginia, Connecticut, Massachusetts, and California.

Trulieve focuses on logistics, cultivating, processing, manufacturing, wholesale, and retail of cannabis and cannabis-infused products. It sells these products through Trulieve branded retail stores. It also has an online website where customers can purchase its products.

Trulieve products include nasal sprays, tinctures, vapes, edibles, dissolvable powders, capsules, topicals, concentrates, and flowers. It sells them through the Roll One, Modern Flower, Loveli, Co2lors, Avenue, Alchemy, Sweet Talk, Muse, Momenta, and Cultivar Collection brands.

The company also has 161 dispensaries, 112 of which are in Florida. Its headquarters are in Quincy, Florida.

BUSINESS

Medical Marijuana Inc’s (OTCMKTS: MJNA) Subsidiary, HempMeds Brasil, Will Sponsor an Obesity Medicine Symposium

HempMeds Brasil, a subsidiary of Medical Marijuana Inc (OTCMKTS: MJNA), will sponsor the first Obesity Medicine Symposium for the Brazilian Society of Obesity. This event will take place on March 3-6, 2022.

The symposium will educate people on the benefits of cannabidiol

The Symposium will be at the Centro South Convention Center, Santa Catarina. It aims to bring together medical professionals, wellness organizations, and educators to talk about technological innovations and techniques that have emerged in treating obesity. HempMeds is sponsoring the event to spread awareness on how cannabidiol can be a crucial step in wellness routines.

According to Matheus Patelli, the Managing Director at Hemp Meds Brasil, the event gives the company a chance to educate people on cannabidiol. It will also highlight the benefits of cannabinoids in wellness, how people can use them, and the research surrounding them.

Patelli adds that the event will benefit both the people and the company as cannabidiol is legal in the country. Moreover, the government subsidizes it, so people know how and when to use it.

HempMeds will also give a presentation

Besides providing sponsorship for the event, HempMeds will also give a presentation on cannabidiol and medical cannabis on March 4. The presentation will touch on products in Brazil, their safety, legality, and applications.

Blake Schroeder, the CEO of Medical Marijuana, states that the company has had high revenue and operational growth in the last few years. Furthermore, its brand presence enabled it to host and sponsor the event. Schroeder adds that it has partnered with high-profile researchers and doctors. This move has allowed Medical Marijuana to educate and be transparent with its customers.

HempMeds Brasil was among the first cannabis companies which the National Sanitary Surveillance Agency has approved to import cannabidiol-based products. The company’s license allows it to supply products to various medical centers.

These products treat multiple sclerosis, chronic pain, Parkinson’s disease, and epilepsy. HempMeds is developing products for other diseases.

HempMeds’ parent company, Medical Marijuana, is a cannabis company that operates under various subsidiaries. Other than HempMeds, or also owns Kannaway. The company also partners with companies like Neuropathix and Axim Biotechnology Inc. Its headquarters are in San Diego, California.

BUSINESS

Fire & Flower Holdings Corp’s (OTCMKTS: FFLWF) Subsidiary, Pineapple Express Delivery Inc, Will Offer Delivery in Metro Vancouver

Pineapple Express Delivery Inc, a subsidiary of Fire & Flower Holdings Corp (OTCMKTS: FFLWF), will offer next business day delivery via e-commerce websites owned by British Columbia Cannabis stores in Metro Vancouver. This will start on February 28, 2022.

Pineapple express makes fast deliveries

Pineapple Express is the most prominent cannabis delivery company. It does over 40,000 deliveries monthly to medical and adult-use cannabis customers in Canada. This company has become an essential part of Fire & Flower holdings since its acquisition on January 25, 2022.

According to the President of Pineapple Express, Randy Rolph, the company recognizes its customers’ need for fast delivery. Cannabis users in the Metro Vancouver area will now take advantage of the subsidiary’s services as it will begin offering next-day delivery services in British Columbia.

Ralph adds that Pineapple Express is very efficient with the fastest and highest scale in the country. The company can also make cost-effective deliveries.

Fire & Flower is a cannabis retailer that has over 100 stores. It uses Hifyre, a technology development subsidiary, to improve its operations and increase revenues. It also educates its customers on cannabis use.

Fire & Flower stores

Fire & Flower sells cannabis products through numerous stores. One of its first stores is Friendly Stranger, which opened in 1994 in Canada. This store has been advocating for cannabis legalization for years.

Friendly Stranger has worked to educate people on the benefits of using cannabis. It has also fought for people who were unfairly charged with cannabis use and made safe hemp products available for the people.

Another store that Fire & Flower owns is Happy Dayz which opened in 2007. The store now has 9 locations in Ontario. Unlike Friendly Stranger, these stores are smaller with an engaging team to give customers a more personalized experience.

HotBox Cannabis is a store that serves customers in Toronto. It also comes with a cannabis consumption lounge at 204 Augusta Street. This lounge, which was the first in Toronto, is near its 206 Augusta store, making it more convenient for cannabis customers. The lounge also sells accessories.

Fire & Flower also uses the Open Field Distribution logo to distribute wholesale products in Saskatchewan.